Blockchain & B-to-B Lending, solution for sustainable growth

Without diversification of funding, SMEs are often left to face liquidity risk alone. Blockchain makes it possible to digitise inter-company lending and to build new cooperations between SMEs and large companies, a factor of sustainable growth

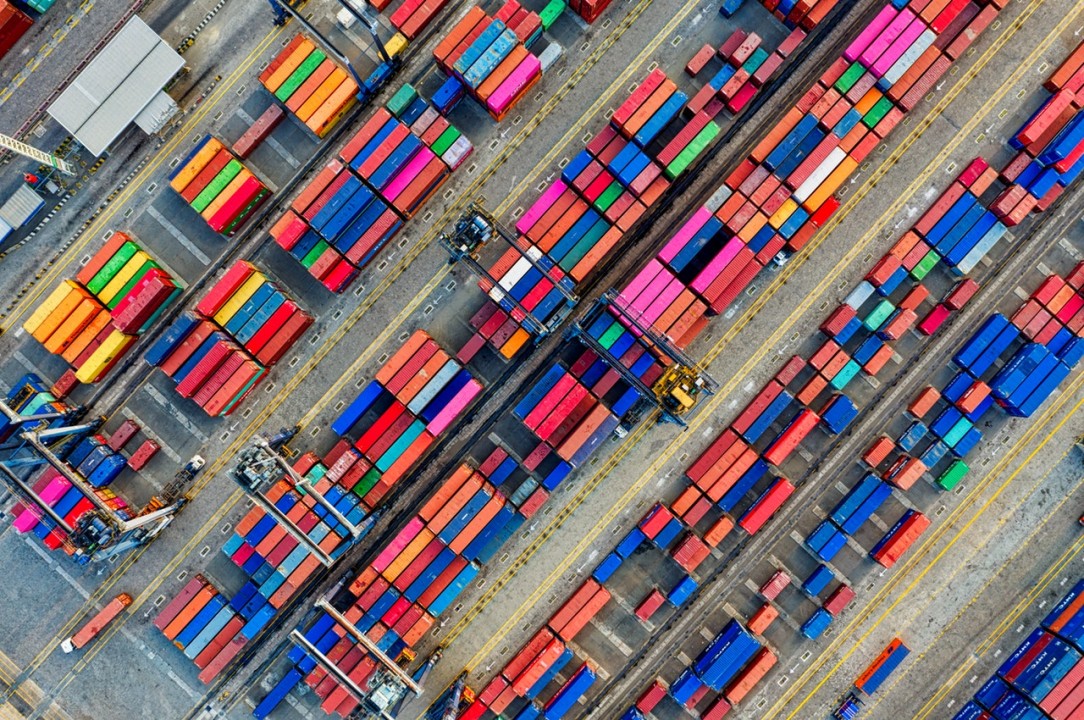

A fragile geopolitical context, risks to Chinese supplies, raging trade wars, and falling interest rates could point to a new financial crisis. In a volatile economic environment, companies all face major risks with fragmented supply chains.

The question today is not when a new global crisis is likely to occur. But rather whether companies are well prepared for the likely dysfunction of the sector or for liquidity risks?

Companies need to secure their sectors. They need a financing system that serves a sustainable economy and consolidates cooperation with their strategic partners.

We invite you to discover how digitalized inter-company loans are a solution for sustainable growth. It can help companies in the same sector to better weather crises and build lasting links.

Financial crisis: liquidity risks for businesses

In the event of a financial crisis, one of the impacts for companies is liquidity risk. To understand the concept of liquidity, let us consider the effects of the financial crisis on the inter-bank market. During a financial crisis, there is a so-called "drying up" of liquidity in the market. In other words, banks no longer lend money to each other, as they are afraid of not being repaid. They also want to preserve their liquidity as much as possible in order to cope with possible future financial difficulties.

In this context, banks that borrow in the short term no longer have any solutions for financing themselves, and can therefore no longer meet their commitments to companies. This is what is known as liquidity risk. This is exactly what happened during the subprime crisis in 2008, with the collapse of Lehman Brothers. In the event of a financial crisis, companies can no longer find new sources of financing. Companies can therefore no longer meet their debts. This is the so-called liquidity risk for companies, and the threat of bankruptcy is high!

Today, it is possible for companies to find alternative means of financing. The objective for them is to not depend on financial institutions that have become too sensitive to global financial markets. Inter-company loans are a sector-based solution for maintaining the growth of a company without going through the banking world, and limiting the liquidity risk for companies!

How does direct business-to-business lending strengthen business-to-business cooperation with the Blockchain?

Inter-company loans: a resilient solution to the crisis

Faced with the risk of liquidity, in times of crisis or not, it is necessary to diversify the sources of financing to ensure the growth of its activity. Like large and medium-sized companies, diversifying their sources of financing is a solution for small and medium-sized companies (SMEs), which have difficulty finding financing and are often confronted with the reluctance of banks, which are increasingly constrained by regulations (Basel III).

Intercompany loans allow companies to continue to grow, even in a crisis. There is less liquidity risk for companies when financing is secured! To make things clearer, let us first define what a business-to-business loan is.

Inter-company lending (direct inter-company financing, intra-group credit, family and/or network credit) is lending between companies. According to the Banque de France, in 2015 it represented more than €1,200 billion, whereas bank loans to companies did not reach €1,000 billion.

Inter-company lending (direct inter-company financing, intra-group credit, family and/or network credit) is lending between companies. According to the Banque de France, in 2015 it represented more than €1,200 billion, whereas bank loans to companies did not reach €1,000 billion.

Direct lending between companies (not belonging to the same group) has been possible since 2016, and in particular allows SMEs to diversify their sources of financing with several financiers. Intercompany lending is therefore an ideal solution to deal with possible financial crises and liquidity risk for companies, as this type of lending does not depend on traditional banking institutions.

Do business-to-business loans facilitate the financing of projects between companies with a view to the sustainability of the sector?

The benefits of digital business-to-business loans

If inter-company lending appears to be an adequate solution to finance oneself without banks, the platform We fundia goes further by reinventing inter-company lending! This digital platform allows companies to lend directly to each other and thus limits the liquidity risk for companies. Cooperation within an ecosystem and security of supply for the sector are their watchwords !

In the context of crowdlending, companies in the same ecosystem (whether by sector or on a territory) can finance each other's projects. Large companies can help smaller ones to develop, without going through the banks !

What is crowdlending ?

Crowdfunding is a form of participatory financing dedicated to businesses. In practice, individuals lend money to businesses for a specific project, which are reimbursed for their investment if the threshold is reached, in return for additional interest. With BtoB crowdlending, companies can finance their projects directly.

The article "Le crédit inter-entreprises en Europe", published in November 2019, by Michel Lescure (professor emeritus at the University of Paris X-Nanterre), reaffirms that inter-company credit meets the needs of companies. He explains that coordination between companies and adaptation to progress are too often perceived as an archaic mode of financing.

France has equipped itself with the means to reinvent inter-company lending with the Blockchain decree for unlisted securities and the regulation of crowdlending. This gives companies autonomy in issuing loans to partner companies.

Digitised business-to-business loans can be made in the form of bonds or minibonds [1] that can be registered in the Blockchain.

The movements of securities are thus recorded in the blockchain. They act as a digital register for unlisted companies. They issue their claims autonomously and exchange them among themselves without intermediaries. These digitised and exchangeable claims provide liquidity for financiers and makes enable them to better control their risk.

Large companies and SMEs can thus build new cooperation by freeing themselves from banking rigidity while developing projects within their sector.

[1] The minibond is a class of redeemable bills, registered in a register and subscribable like bonds.